Sales Tax Exemption

Under current law, charitable nonprofits in North Carolina pay sales and use tax on their purchases and can apply for semi-annual refunds of the taxes they pay. A system of sales tax exemption would save nonprofits time and reduce administrative burdens. Bipartisan bills in both the House (H.B. 882) and Senate (S.397) would replace the nonprofit sales tax refund system with sales tax exemption for most 501(c)(3) nonprofits.

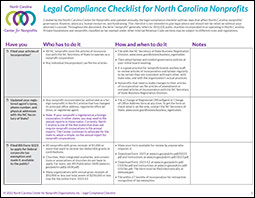

Legal Compliance Checklist for North Carolina Nonprofits

Get the up-to-date Legal Compliance Checklist!

Get the up-to-date Legal Compliance Checklist!

Created by the North Carolina Center for Nonprofits and updated annually, the Legal Compliance Checklist for North Carolina Nonprofits outlines laws that affect North Carolina nonprofits’ governance, finances, advocacy, human resources, and fundraising.