Last updated 9/17/2020

Jaime Campbell, CPA, Tier One Services, LLC

Auditing is an information service. As such, many forward-thinking auditors have already been working virtually for years, as evidenced by their vacation photos posted on Facebook while they were conducting “analytical procedures” from their laptops, which they bring with them everywhere, including the bathroom.

The primary difference between an in-person audit and a virtual audit is the adherence to Generally Accepted Zoom Principles, which dictate the threshold for the number of times that someone says, “Can you see my screen?” and “Sorry, you’re still on mute, can you repeat that?”

But with the primary tactic of the audit to obtain evidence about the amounts and disclosures in the financial statements, the time has finally arrived in which auditors can finally escape having to go through the filing cabinets in your 8x12 office space in order to pull source documents with residue of unknown origin in the upper right-hand corner. And those damn staples.

Phase 1

You might receive the engagement letter via Docusign, Adobe Sign, Practice Ignition, or another online app instead of the traditional in-person meeting requiring donuts in which your auditor gives you a dirty look for getting powdered sugar near their laptop. “Old school” auditors will use Microsoft Word, or even a Word document that has been printed, then scanned noticeably askew, then e-mailed. It’s okay; you’ll get through this together.

No worries, there will still be that initial call to plan the audit, propose a timeline, and to give the auditor an opportunity to judge you, particularly the quality of your virtual background.

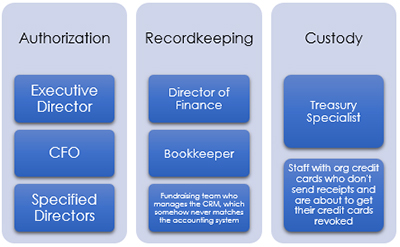

The planning phase is also an excellent time for you to share your internal control documentation with the auditor. Internal controls are policies and procedures that protect organizational assets and ensure reliable financial reporting, such as this handy illustration of separation of duties, which absolutely does not show how many times the executive director has cut checks to unknown vendors and failed to tell the bookkeeper.

Another vital resource for helping you level up your organization’s financial security is this excerpt from Helpful Explanations of Accounting Terminology:

Phase 2

Frankly, with the exception of physical inventory counts, field work hasn’t needed to be conducted in person in 20 years, but this was the only way that auditors could show their fun, extroverted side, as evidenced by the fact that they left their desks.

Seriously, though, the best way to avoid having to scan hundreds of documents at audit time is to prevent them from being printed in the first place. Arrange for electronic delivery of statements, bills, contracts, and receipts. Store them securely and electronically, and upload them for the auditor or even give your auditor direct access to the system in which they are stored.

Bonus: If your organization has a conservancy mission, turn the annual audit into a fundraising opportunity! “We’re having a 5K event,” your digital flyers say. “Sign up for a team today and pay a quarter for every one of these 5,000 electronic, never-printed documents uploaded to the auditor!” This is sure to generate a great deal of enthusiasm, as audits always do.

Phase 3

Certain accounting systems have features which can make a virtual audit nearly seamless for your organization and amazingly efficient for your audit team. These include:

- The ability to grant access to your auditors so they can run all of the financial reports they need and even integrate the accounting system with their audit software so they can import your trial balance and then ask you to run all of the financial reports anyway even though you just gave them direct access to your accounting system.

- The ability to attach source documents directly to transactions, contact names, and/or list elements, so the auditors can more efficiently examine the five-year agreement you signed for printers the size of a parking space which are all sitting dormant because your organization is now digitized.

The next aspect of handling a virtual audit that should be addressed in the upfront phase is the system for secure document transfer. The auditor does NOT want to receive ninety-seven e-mails called “Document” as you e-mail invoices, receipts, contracts, minutes, bank statements, and photos of your whiteboard from the board retreat. Many auditors use a well-organized, secure online system for requesting and receiving your source documents. In fact, one of the advantages of a virtual audit is that you will not hear your auditor curse as you helpfully upload your documents AND e-mail them anyway, just in case.

If your savvy organization has already become “virtual” and you have adopted a workflow management system such as Asana, ClickUp, Basecamp, or Trello, feel free to create a project for the audit and invite your auditors to it if they’re not already using one. Most auditors appreciate the efficiency of the organized space, and the ones who resist it were going to deliver the “Audited Financials final FINAL v03.pdf” three months late anyway, so this is a pretty good way to get a heads-up and plan accordingly.

Phase 4

A virtual presentation of the financials to the board is a great opportunity to showcase the organization’s financial health, technological savvy, ingenuity in adapting to changing times, and ability to save on sandwich platters and bottled water.

You can invite your board members to tune in via video call, and enjoy a real governance experience as three of them swear that they can see the financials on their phones and one is on a treadmill. Your board is sure to show their appreciation for your leadership acumen and for the audit team’s assurance service with any of the following expressions of gratitude.

Jaime Campbell, CPA, MBA, CGMA, CTT, MCT is the co-owner of Tier One Services, LLC, an accounting firm serving organizations advancing social justice, including nonprofits and for-profit social enterprises. Jaime is a former auditor. Her firm, as outsourced CFOs and complete accounting departments for their clients, serves as the primary liaison between their nonprofit clients and the clients’ independent auditing firms.